Giusto per far capire un po' la situazione:

I am about to take a two week vacation (though will update the blog). I had some time off earlier in the summer, but it was dominated by the concerns of a father of a Little League baseball pitcher. Rather than worrying about mechanics and scoring, I will be contemplating the tragedy that is Europe and I think Italy is the keystone.

Italy is the largest piece of counter-evidence of the German-ECB narrative that the lack of fiscal discipline is at the center of the crisis. Italy's actual budget deficit in 2010 was 4.6% of GDP. The deficit for the euro zone as a whole was 6%. The Dutch reported a 5.4% deficit and France showed a 7% shortfall. Spain's deficit was twice Italy's.

Italy did have a deficit problem, but that was years ago. Those policy errors are part of the reason that Italy has accumulated debt that is approaching 120% of GDP.

The other part of the reason is that Italian growth has ceased. Its average growth rate over the past decade is less than 0.25%. Eurozone growth has averaged 1.1% over the same period. Moreover, Italy has experienced a steady increase in its labor force as a result of 3 mln immigrants (estimates suggest about a third entered the work force). On a per capita basis, Italy has become poorer.

The past deficit plus slow growth has created the mountain of debt. With the wolf knocking on the door and 10-year bond yields pushing above 6% last month, the Italian government responded with new austerity measures in early August.

This did not prove sufficient and the ECB insisted on yet another round of austerity as the condition under which it would buy Italian bonds in the secondary market, over the objections of four ECB members, including Axel Weber's successor at the Bundesbank.

The ECB's bond buying is not sustainable. There appear to be some potential technical problems with neutralizing/sterilizing increasing amounts, but more importantly, the ECB is buying the bonds reluctantly and as a stop gap measure until the reforms agreed July 21 of the EFSF are approved. That is proving to be more of a problem than many expected as the dispute over Greek collateral threatens to postpone if not outright jeopardize that agreement.

There may also be a political backlash against the ECB, which could take many forms, including wider spread criticism of the deterioration of its larger balance sheet. The German Constitutional Court is expected to make a ruling in the first part of September.

Even more importantly, is scale. Already the ECB buying of Italian bond seems to have reached a point of diminishing returns. Italian 10-year bond yield rose around 13 bp this past week and at 5.06% is at a two week high. What happens when it steps away ?

Italy has around $250 bln of bond maturing in H2 11 and another $352 bln maturing next year. The ECB has holds an estimated 20% of Greek, Portugal and Irish outstanding bonds. It does not have the political will to do the same for Italy and Spain and even the new EFSF is unlikely to be large enough. The rules and conditions for the EFSF's precautionary lines of credit are not clear yet and Italy probably can't count on it anytime soon.

The fact of the matter is that in every year since 1991, Italy has reported a cyclically adjusted primate balance surplus. There has been no spike that other countries have experienced in debt levels.

European officials have implicitly and explicitly indicated that reaching austerity targets is more important than reviving growth. That calculus threatens Italy.

Even before this month's two austerity packages, the Italian economy was sputtering. Yes it appears to have eked out a little more growth than Germany's Q2 0.1% performance, but the economy lacks any upside momentum in Q3. The service PMI was below 50 in June and July/ It likely remained below the boom/bust level in August. The manufacturing PMI has averaged about 50 in the June/July period but is likely to have fallen below 50 in August (to be reported Sept 1).

The fact that Italy's 5-year CDS prices remain elevated (376 now vs. 388 on Aug 4 peak) warns that ECB bond buying, fiscal austerity has not convinced private sector investors that the worst is truly past. This offers a poor backdrop from the large maturities that are set to take place.

As goes Italy, so goes EMU.

-----------------------------------

7 Reasons This September Should Terrify Investors

In addition to any unanticipated surprises from natural disasters or final straws for the EU, here are 6 known events that could really rock markets or even make history. Jews won’t be the only ones who should be praying harder in weeks ahead...

4 Things That Could Cause Another EU Crisis – Or Collapse

The Assumption Of Unwavering German Support Could Die – And With It, The Euro-zone As We Know it

September 7th – Germany’s Constitutional Court Ruling On Legality of Assorted Bailout Policies: It’s been widely assumed that the court would present a problem for Germany’s prior or future EU bailout commitments. We’ve seen a lot of assumptions about the EU die over the past year.

No Bailouts: RIP Spring 2010: Ok, so the EU would have a little moral hazard issue.

The EU Stands Behind Member Debts: RIP July 21, 2011: Uh-oh, EU debt is riskier than we thought. Hey, do we have any Spanish or Italian bonds?

Germany Not Necessarily Behind The Bailouts? EU RIP

September 23rd- German Parliament Votes On Greek Bailout: Germany has lead the bailout fight, has the strongest economy in Europe, and as the primary funding nation its full participation and leadership in any rescue scheme is non-negotiable for the EZ to survive.

However, as The Telegraph’s Ambrose Evens-Pritchard reported last week, there is mounting evidence that assumptions of German support may not be justified.

He notes that German President Christian Wulff warned that Germany is reaching bailout exhaustion and cannot allow its own democracy to be undermined the EU’s needs for German help. Here are a few quotes:

“I regard the huge buy-up of bonds of individual states by the ECB as legally and politically questionable.” …”[The ECB had gone] “way beyond the bounds of their mandate” by purchasing €110bn (£96.6bn) of bonds, echoing widespread concerns in Germany that ECB intervention in the Italian and Spanish bond markets this month mark a dangerous escalation

President Wulff said Germany’s public debt has reached 83 pc of GDP and asked who will “rescue the rescuers?” as the dominoes keep falling. “We Germans mustn’t allow an inflated sense of the strength of the rescuers to take hold,” he said.”

“Solidarity is the core of the European Idea, but it is a misunderstanding to measure solidarity in terms of willingness to act as guarantor or to incur shared debts. With whom would you be willing to take out a joint loan, or stand as guarantor? For your own children? Hopefully yes. For more distant relations it gets a bit more difficult,” he said.

Wulff warned that German leaders “have to stop reacting frantically to every fall on the stock markets. They mustn’t allow themselves to be led around the nose by banks, rating agencies or the erratic media,” he said…..“This strikes at the very core of our democracies. Decisions have to be made in parliament in a liberal democracy. That is where legitimacy lies.”

Chancellor Angela Merkel has struggled all this week to placate angry critics of her bailout policies within the Christian Democrat (CDU) party. Labour minister Ursula von der Leyen said countries that need rescues should be forced to put up their “gold reserves and industrial assets” as collateral, a sign that rising figures within the CDU are staking out eurosceptic positions as popular fury mounts.

Marc Ostwald from Monument Securities said Germany is drifting towards a major constitutional crisis. “This has all the makings of the revolt that unseated Helmut Schmidt [in 1982], and indeed has political echoes of the inefficacy of the Weimar regime,” he said.

Evans- Pritchard concludes that these “carefully scripted comments are the clearest warning to date that Germany has reached the limits of self-sacrifice for Europe. The assumption that it will always – after much complaining – sign a cheque to keep the project of the road, no longer holds.”

However even if German support for the Greek rescue finally comes together, Germany will not vote on the Greek bailout agreement until September 23rd , and bad things can happen before then.

Other Imminent Threats To The EU

Other EU Member Votes On The Greek Plan

Other countries could take even longer to agree to the plan, and any changes or special requests must be approved by all member states.

We have not even considered delays and failures to ratify the plan that could arise from new demands for collateral, now that the Greeks have inexplicably thought they could agree to provide Finland with cash collateral without risking a wave of similar requests from others. How can any other EU leader who walks away without similar guarantees and not look like a sucker?

Ongoing EU Sovereign Liquidity Crisis: As noted in PRIOR WEEK MARKET MOVERS: JACKSON HOLE DISTRACTS WHILE EU COLLAPSING, the EU banking system is hitting a worsening liquidity crises as failure to resolve the broader sovereign debt crisis is casting doubt on the banks most exposed to the questionable GIIPS sovereign bonds.

Threats From The US: Ongoing US Stimulus, Debt Issues

September 21st- Fed Meeting Widely Anticipated To Bring New Stimulus: With global growth slowing the big hope for risk assets is additional stimulus. A decisively pro or anti stimulus stance from the Fed could easily send markets on a new rally or on the next leg down of the bear market that began in 2007

Throughout the week leading up to the Jackson Hole symposium, markets gyrated with sentiment about whether there would be new stimulus announced to support asset prices. The belief remains that the Fed will do something, only now announcement of that something has been deferred to the September 21st Fed meeting, which has been extended an extra day, prompting speculation that this will be the time new measures are announced. However, anything that remotely suggests additional deficit spending could spark another paralyzing battle in Congress.

September 30th Deadline To Pass US Budget In Congress: If there is no US debt crisis in the wake of the Fed meeting, this coming budget battle could easily become a congressional catfight that reveals political deadlock, paralysis, and undermines the belief in Washington’s ability to deal responsibly and decisively with its deficits. As Bruce Krasting writes here:

The last time we went through a vote on a continuing resolution was just four months ago. That fight went down to the wire. At the time it was 50-50 that the government would be forced to shut down. In the end a deal was reached to extend things to the end of this fiscal year. That happens to be just six weeks from today.

The fight back in April was the opening salvo of the war between Democrats and Republicans. I think this was the first definitive evidence that our government was so deeply divided that it had become dysfunctional.

It was the debt ceiling catastrophe that drove S&P to cut the US credit rating. The seeds for that ratings cut came from the Continuing Resolution debacle.

To get a new Resolution through the house the Democrats and the WH will have to make concessions. We’ve seen where this takes us. Crisis.

Too Much Damned Uncertainty: With so many landmines scattered throughout September, the sheer heightened uncertainty makes markets that much more prone to selloffs.

-------------------------------------------

A sceptic’s solution – a breakaway currency

By Hans-Olaf Henkel

Having been an early supporter of the euro, I now consider my engagement to be the biggest professional mistake I ever made. But I do have a solution to the escalating crisis.

I have three reasons for my change of heart. First, politicians broke all promises of the Maastricht treaty. Not only was Greece let into the eurozone for political reasons, also the fundamental rule, “no member to exceed its yearly budget deficit by the equivalent of 3 per cent of gross domestic product”, was broken more than a hundred times. Mandatory punitive charges were never applied. To top it all: the “no bail-out” clause was wiped out in the wake of the first Greek rescue package.

Second, the “one-size-fits-all” euro has turned out to be a “one-size-fits-none” currency. With access to interest rates at much lower German levels, Greek politicians were able to pile up huge debts. The Bank of Spain watched the build-up of a real-estate bubble without being able to raise interest rates. Deprived of the ability to devalue, countries in the “south” lost their competitiveness.

Third, instead of uniting Europe, the euro increases friction. Students in Athens, the unemployed in Lisbon and protesters in Madrid not only complain about national austerity measures, they protest against Angela Merkel, the German chancellor. Moreover, the euro widens the rift between countries with the euro and those without. Of course Romania would love to join, but does anybody believe Britain or Sweden will find it attractive to join a “transfer union”? Meanwhile, dissatisfaction with the euro drags down the acceptance of the EU itself.

Instead of addressing the true causes, politicians prescribe painkillers. The euro patient suffers from three discrete diseases: as a result of the financial crisis, many banks are still unstable; the negative effects an overvalued euro has on the competitiveness of the “south”, including Belgium and France; the huge level of debt of some eurozone countries. It would be misleading to proclaim there is an easy way out. But it is irresponsible to maintain there is no alternative. There is.

The end result of plan “A” – “defend the euro at all cost” – will be detrimental to all. Rescue deals have led the eurozone on the slippery path to the irresponsibility of a transfer union. If everybody is responsible for everybody’s debts, no one is. Competition between politicians in the eurozone will focus on who gets most at the expense of the others. The result is clear: more debts, higher inflation and a lower standard of living. The eurozone’s competitiveness is bound to fall behind other regions of the world.

As a plan “B” George Soros suggests that a Greek default “need not be disorderly”, or result in its departure from the eurozone. But a Greek default or departure from the eurozone implies risks too high to take. First in Athens, then Lisbon, Madrid and perhaps Rome, people would storm the banks as soon as word got out. A “haircut” would not improve Greece’s competitiveness either. Soon, the Greeks will have to go to the barber again. Anyway, we now talk also about Portugal, Spain, Italy and, I am afraid, soon France.

That is why we need a plan “C”: Austria, Finland, Germany and the Netherlands to leave the eurozone and create a new currency leaving the euro where it is. If planned and executed carefully, it could do the trick: a lower valued euro would improve the competitiveness of the remaining countries and stimulate their growth. In contrast, exports out of the “northern” countries would be affected but they would have lower inflation. Some non-euro countries would probably join this monetary union. Depending on performance, a flexible membership between the two unions should be possible.

Implementing plan “C” requires that four underlying problems are addressed separately. We must rescue banks, not countries. Stabilisation of banks on a national level should replace current European umbrellas. In many cases, this requires temporary bank nationalisation. Second, Germany and its partners in a new currency must forgo a significant portion of their guarantees to help refinance Greece, Portugal and others. As much of this money is already lost, this is an acceptable price for an “exit ticket”. Third, there must be a new European central bank based on the Bundesbank, preferably not led by a German. The new currency should not be called the “D-Mark”. Fourth, mechanics for entry would be similar to those for getting into the euro. If it was possible to form one currency out of 17, it should also be possible to form two out of one.

This plan will not be easy, but we need to focus on saving Europe, not the euro. This requires the conviction and foremost courage of Ms Merkel. Paradoxically, help could come from the south, where voters are getting tired of her lectures on what to do. For north and south, an end with difficulties is better than difficulties without an end.

-----------------------------------------------------------

Dai cds timori di nuove tensioni sul credito

di Luca Davi

Mentre le valutazioni borsistiche di molte banche, in Europa come negli Stati Uniti, stanno atterrando ai minimi del 2009, le quotazioni dei Cds – ovvero di quelle particolari polizze assicurative che permettono di proteggersi dal rischio di default di una controparte – sono andate già oltre.

E mettono in conto uno scenario anche peggiore a quello cui si è assistito all'apice del terremoto post Lehman, nel 2008-2009. Basti pensare che ieri l'indice dei Cds dei 25 principali titoli finanziari europei, l'iTraxx Europe Senior Financials index, ha toccato il livello di 252 punti, una quota mai vista prima. I Cds a 5 anni di Credit Suisse, ad esempio, sono schizzati del 9,3%, registrando un rialzo del 32% in una settimana. Un po' come Ubs, il cui Cds in giornata è salito del 7,9%, facendo segnare un picco del 31,4% in una settimana. Le italiane, in questo scenario, non stanno molto meglio, con aumenti settimanali del 17% circa per UniCredit, Intesa Sanpaolo e Mps.

Per tutta la giornata si sono rincorsi rumors di possibili difficoltà di accesso al mercato della liquidità da parte di alcuni istituti, cui si aggiungono le tradizionali incertezze sulla risoluzione dei problemi dei debiti sovrani in Eurozona. Ma del resto la crescente difficoltà incontrata dalle banche europee a finanziarsi attraverso il canale interbancario è un tema che preoccupa parecchio gli investitori. Non che, però, negli Stati Uniti le cose vadano molto meglio. Lo spread sui Cds a 5 anni di Bank of America ieri é salito di 47 punti a quota 427, un livello superiore a quello toccato nei momenti più bui della crisi finanziaria del 2008. In volo anche i cds di Goldman Sachs che si assestano a quota 283 punti (+28 punti base), il livello più alto dall'aprile 2009.

È vero: il mercato dei Cds è poco trasparente, molto illiquido e facilmente manipolabile. E per questo i suoi movimenti vanno presi con le pinze. Ma una variazione, soprattutto quando rilevante, rappresenta pur sempre un'indicazione interessante dell'umore degli operatori. Che oggi, come non mai, appare tutt'altro che buono.

---------------------------------------------

Christine Lagarde:

Banks need urgent recapitalization. They must be strong enough to withstand the risks of sovereigns and weak growth. This is key to cutting the chains of contagion. If it is not addressed, we could easily see the further spread of economic weakness to core countries, or even a debilitating liquidity crisis. The most efficient solution would be mandatory substantial recapitalization—seeking private resources first, but using public funds if necessary. One option would be to mobilize EFSF or other European-wide funding to recapitalize banks directly, which would avoid placing even greater burdens on vulnerable sovereigns…

[...]We have reached a point where actions by all countries, doing what they can, will add up to much more than actions by a few.

There is a clear implication: we must act now, act boldly, and act together.

----------------------------------------

Is The ECB Starting To Lose Its Grip On Italy And Spain?

The strong run for stocks is continuing into a second week. But despite all of the Fed-inspired euphoria these last few days, signs of trouble continue to lurk under the surface. The latest helping of poor U.S. economic data has been the most prominent in the headlines, with Tuesday’s plunge in consumer confidence to the lowest levels in over two years just the latest in a long line. But a more troubling sign is starting to develop in Europe.

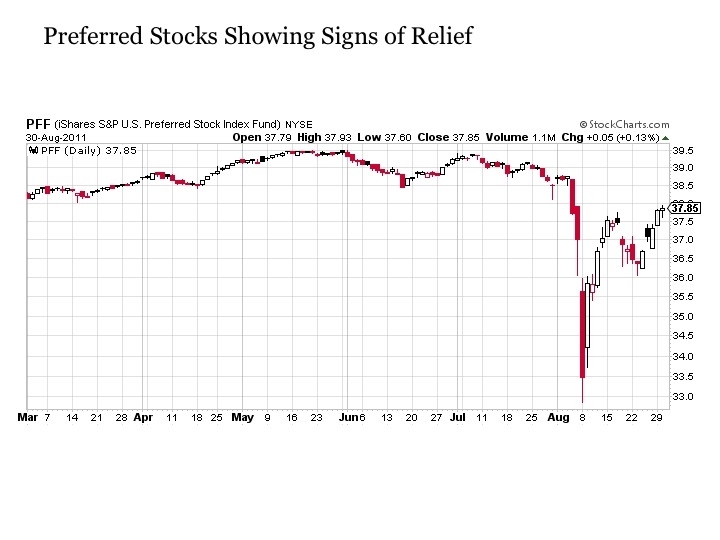

In a recent article, I discussed two key indicators to watch for stocks. These readings are the preferred stock market and the government bond yields in Spain and Italy. If either of these readings began to fail, the pressure on stocks could quickly become severe.

The good news is that the preferred stock market has shown signs of renewed life in recent days. After creeping lower through last Tuesday, preferred stocks as measured by the iShares S&P U.S. Preferred Stock Index (PFF) have rallied for five days straight through this Tuesday and are quickly closing in on returning to normal levels. This is a positive sign as it suggests that recent concerns about bank solvency have moved to the backburner, at least for now. The PFF is quickly heading toward resistance in the $38.15 to $38.20 range at both its 50-day and 200-day moving averages, so this is setting up to be a key test in the coming days. But so far, so good.

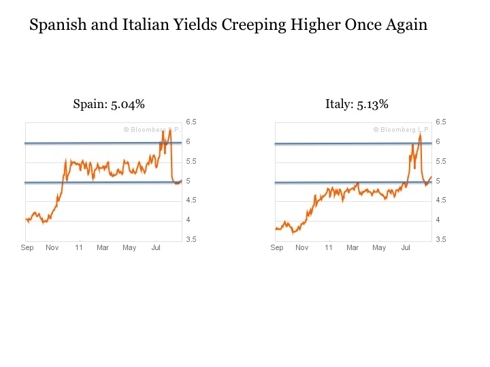

The same cannot be said for the situation in Spain and Italy. In early August, the 10-year government bond yields for both countries spiked sharply higher to above 6%. At these levels, the ability of both countries to continue to finance themselves begins to come into serious question. As a result, the European Central Bank intervened roughly two weeks ago and began buying these bonds aggressively in order to release this pressure. And they quickly succeeded, as 10-year government bond yields quickly descended to 5% and remained effectively pinned right on this mark in the days since -- that is, until just a few days ago.

Starting last Wednesday, the Italian 10-year government bond yield began drifting slowly higher, has continued rising above the 5% level for five straight trading days since and is now at 5.13%. This recent upward movement can be explained by the following. First, Italy has had some notably weak bond auctions in recent days. And despite the fact that the ECB has been buying Italian debt aggressively in the secondary market (the ECB cannot purchase debt at initial auction), it's been unable to fully contain the recent rise in yields. Further complicating the situation, the Italian government has been slowly scaling back the austerity plan it put in place to gain ECB support for its bonds in the first place. This is eroding market confidence in the ability of Italy to deliver on their commitments to maintain this support going forward.

Spanish debt has also begun to show some renewed signs of deterioration. After staying pinned at the 5% level, the Spanish 10-year government bond yield has also begun to creep higher to 5.04%. This is a very modest move, but it bears watching in the next few days as the Spanish are scheduled for a €4 billion auction on Thursday. If this goes off poorly, more pressure on yields can be expected.

Further complicating matters is an upcoming vote in Germany next Wednesday. The ECB is the last line of defense in capping the yields in Italy and Spain until the European Financial Stability Facility eventually takes over sometime in the coming months. But the German Constitutional Court is scheduled to convene next Wednesday, September 7 to determine the legality of the ECB’s recent bond purchasing actions to support these governments. If the vote next Wednesday goes against the ECB, the likely spike in European government bond yields and subsequent tremors through global stock markets could quickly overwhelm any recent hopes about further accommodation from the Fed later in the month.

Fortunately, two broad areas of investment markets continue to perform well in reflection of these risks. The first is the Treasury market, which continues to hold strong amid concerns over the health of the U.S. economy and ongoing risks in Europe. If the recent stock rally were truly sustainable, we would have likely seen a sell off in Treasuries by now. And those that are attributing recently low Treasury yields to the likelihood of further Fed easing coming soon likely have it backwards, as this would if anything send Treasury yields rising just as it did during QE1 and QE2. Yields are most likely remaining low because risks throughout the global economy remain extreme.

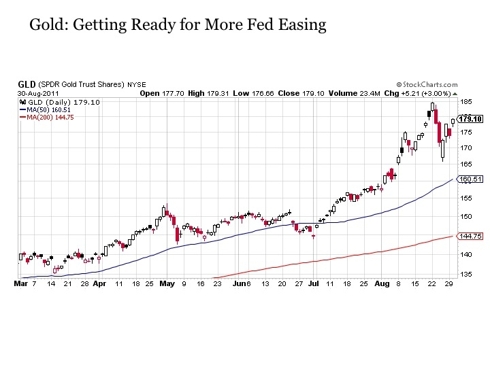

The second strong performers are precious metals including gold and silver. Not only do both of these hard assets provide investors protection against crisis, but the fact that expectations are rising that the Fed will be delivering some sort of monetary stimulus at their upcoming meeting on September 20 is also providing support. Look for both gold and silver to continue to rise as long as the sentiment is building for further easing from the Fed in September.

September promises to be a very interesting month for the global economy and markets. Pivotal events will be coming almost daily that may cause investment markets to twist and turn dramatically at any given moment.

------------------------------------------------

Dear Mr Henkel,

I cannot agree more with your analysis on the current situtation. However, I do not agree at all with the remedy that you have proposed. Plan A has failed and Plan B will not succeed either. This is where we agree. However your Plan C is doomed to fail too ...or to lead to the complete desintegration of the European Union, with potentially the split-up of some Member States, riots and civil war in some places of Europe.

We should not call this a success, neither an end with difficulties. The Southern common currency will collapse from Day 1. All its members will immediately lose access to the bond markets: all of them will have to resort to a new national currency and nationalise all their banks. Huge currency volatility will transform the common market into a relic of the past. Freedom of capital will be abolished too.

The Northern common currency will survive for a while ...but not for long, alas. This new D-Mark will not save Germany... Interest rates will increase in all of its members since the monetary mass of the new currency will be reduced. The Nothern countries will be hit progressively by the protracted recession affecting the Soutern countries. The Debt to GDP ratio will raise rapidly to dangereous level, especially in Germany where this ratio is already high.... with no prospect of quantitive easing on the side of the new central bank. And again the most fragile members of the Nothern monetary Union will be subjected to attacks by speculators...

"Plan D", which consists of Eurobonds without a fiscal union, will not work either for reasons you have well explained. If all Euroland Members are responsible for the Eurobonds, none will feel responsible and eventually Eurobonds will default: at a certain point in time, the most "wealthy" Member States will not be willing or then financially able to pay for others Member States which have defaulted.

Our political decision-makers and our business leaders - you are part of them- have to understand that the only way out of the ballooning crisis is to resort to a significant level of fiscal federalism amongst Euroland members. This means:

- The direct levy by Brussels of most of the VAT (at least the first 15% of the various national VAT rates), with as bonus the prospect to defeat the current tax evasion, which is based on VAT carrousel and which is costing to European treasuries for the time being three to four times the current EU budget; the centralised VAT should serve as collaterals for Eurobonds;

- The mandatory termination of the fiscal competition amongst Member States, meaning that Ireland must dobble its 12.5% coporation tax rate, Greece -and all Member States that have mimicked her - must dismantle its tonnage tax,

- the European Central Bank should be allowed by the Treaty to resort to quantative easing for Eurobonds if need be.

Our political decision-makers have to understand that the consequences of the meltdown of the eurozone will by far outweigh the short term economic advantages for Germany and some other Nothern countries. The desintegration of the common currency will lead to an unprecedented economic crises for Europeans, to the dissolution of the European Union (since most Members will be unable to contribute to its budget), to civil unrests and even civil war in states where the national administration is likely to vanish...

What is clear is that the Europeans are far from agreeing on a solution and on what the political consequences that THE solution - or the absence of it - would imply...

Yours sincerely

----------------------------------------------------

Europe’s rescue fund faces political demands that risk hobbling its response to emergencies as the 17 euro-area governments prepare to ratify its overhaul.

The fund, known as European Financial Stability Facility, would have to wait for a request from a debt-hit government before buying its bonds in the secondary market, its new statute shows. The extra step, along with German lawmakers’ demand for control, may make it less responsive than the European Central Bank, which has bought 115.5 billion euros ($167 billion) of bonds in the past 16 months to calm markets.

“What’s clear is that even if the EFSF is ostensibly equipped to react swiftly in an emergency, it will be much less dynamic than the ECB,” said Daniela Schwarzer, senior analyst at the Berlin-based German Institute for International Politics and Security. “Faced with an emergency I would be inclined to put my money on the bank taking the reins of rescue action -- as it has done and is doing.”

The retooled rescue fund, the product of a July 21 emergency summit, came as euro-area leaders approved a second Greek bailout, trying to arrest a debt crisis that has spiralled from a 2009 fiscal headache in Athens to a global economic risk.

The 48-page revision to the EFSF statutes, dated Aug. 26, gives legal form to the summit decision to enable the fund to buy bonds trading on the market, offer precautionary credits and lend money to recapitalize banks. The need for governments to seek a bond-buying effort wasn’t part of the summit statement.

‘Acting With Unanimity’

Euro-area finance ministers “acting with unanimity” would set guidelines for the pricing and terms of bond purchases as well as “monitoring of compliance with policy conditionality,” according to the draft obtained by Bloomberg News.

Internal divisions didn’t prevent the ECB from restarting bond purchases last month, buoying Italian and Spanish markets. The show of force helped send their 10-year debt yields down more than 100 basis points from euro-era records.

The overhauled fund will wield 440 billion euros. European officials such as European Commission President Jose Barroso have said more may be needed to extend the aid umbrella from Greece, Ireland and Portugal to large countries such as Italy and Spain.

“The market will very quickly perceive and focus on the limited dimensions of the European Financial Stability Facility,” said James Nixon, chief European economist at Societe Generale in London. “Simply far too much is being asked of it. It was never dimensioned for the tasks that are now being laid at its door.”

Collateral Demands

Final approval of the overhaul may founder on Finland’s demand for collateral from Greece. Finland’s talks with Greece triggered calls for similar treatment from nations including Austria and the Netherlands, threatening to delay or scupper the second Greek bailout.

“The final construct just looks so far away now, it’s eroding the fund’s effectiveness when it finally gets up and running,” said Julian Callow, chief European economist at Barclays Capital in London. “The political squabbling is doing it a great disservice.”

Lawmakers in Germany, which shoulders the biggest crisis- management burden, are seeking to keep the fund on an even tighter leash, insisting that the parliament dictate the German stance on future loans and bond acquisitions.

Chancellor Angela Merkel’s Cabinet cleared the way for ratification of the reinforced fund yesterday after offering assurances of an enhanced oversight role for the parliament.

German Debate

Merkel’s Cabinet failed to hash out the Bundestag’s precise powers, leaving that debate to fester until the Sept. 29 ratification vote. The political mood may be swayed by regional elections on Sept. 4 and 18 and a Sept. 7 German high-court ruling on the constitutionality of the euro rescues.

Finance Minister Wolfgang Schaeuble warned lawmakers against wielding their influence to undermine the fund’s effectiveness, saying has “just one request” to those pressing for a say on future bailouts.

“It has to be done in such a way that this financial agency can carry out its stabilizing function for the financial markets and the euro,” Schaeuble said in an interview with ARD television last night.

Giving lawmakers in Berlin more control over the EFSF represents a political price of Merkel’s July decision in Brussels to abandon her opposition to expanding the fund’s powers. ECB President Jean-Claude Trichet and Barroso are among officials across Europe who had pressed Merkel for months to allow an expanded EFSF role.

Sweeping Control

Germany should have sweeping control over the operations of the enhanced EFSF, according to a working paper that coalition lawmakers will consider today. The demands include a parliamentary veto right over new applications for aid by euro region states, the right to approve the fund’s buying of bonds and making loans to help ailing banks, as well the right to approve changes to existing loan conditions.

If accepted by the coalition parties, the proposals will be incorporated into a national EFSF bill that will be pushed through parliament in Berlin by the end of the month.

All euro countries have to approve the upgraded EFSF, with contentious votes also looming in countries such as Finland, Austria, the Netherlands and Slovakia.

Bonds bought by the fund “can either be held to maturity or sold in accordance with the applicable guidelines,” according to the draft. Those guidelines -- including how to finance and execute the purchases -- will be spelled out at a later date by the finance ministers.